-

Afrikaans

Afrikaans -

Albanian

Albanian -

Amharic

Amharic -

Arabic

Arabic -

Armenian

Armenian -

Azerbaijani

Azerbaijani -

Basque

Basque -

Belarusian

Belarusian -

Bengali

Bengali -

Bosnian

Bosnian -

Bulgarian

Bulgarian -

Catalan

Catalan -

Cebuano

Cebuano -

Corsican

Corsican -

Croatian

Croatian -

Czech

Czech -

Danish

Danish -

Dutch

Dutch -

English

English -

Esperanto

Esperanto -

Estonian

Estonian -

Finnish

Finnish -

French

French -

Frisian

Frisian -

Galician

Galician -

Georgian

Georgian -

German

German -

Greek

Greek -

Gujarati

Gujarati -

Haitian Creole

Haitian Creole -

hausa

hausa -

hawaiian

hawaiian -

Hebrew

Hebrew -

Hindi

Hindi -

Miao

Miao -

Hungarian

Hungarian -

Icelandic

Icelandic -

igbo

igbo -

Indonesian

Indonesian -

irish

irish -

Italian

Italian -

Japanese

Japanese -

Javanese

Javanese -

Kannada

Kannada -

kazakh

kazakh -

Khmer

Khmer -

Rwandese

Rwandese -

Korean

Korean -

Kurdish

Kurdish -

Kyrgyz

Kyrgyz -

Lao

Lao -

Latin

Latin -

Latvian

Latvian -

Lithuanian

Lithuanian -

Luxembourgish

Luxembourgish -

Macedonian

Macedonian -

Malgashi

Malgashi -

Malay

Malay -

Malayalam

Malayalam -

Maltese

Maltese -

Maori

Maori -

Marathi

Marathi -

Mongolian

Mongolian -

Myanmar

Myanmar -

Nepali

Nepali -

Norwegian

Norwegian -

Norwegian

Norwegian -

Occitan

Occitan -

Pashto

Pashto -

Persian

Persian -

Polish

Polish -

Portuguese

Portuguese -

Punjabi

Punjabi -

Romanian

Romanian -

Russian

Russian -

Samoan

Samoan -

Scottish Gaelic

Scottish Gaelic -

Serbian

Serbian -

Sesotho

Sesotho -

Shona

Shona -

Sindhi

Sindhi -

Sinhala

Sinhala -

Slovak

Slovak -

Slovenian

Slovenian -

Somali

Somali -

Spanish

Spanish -

Sundanese

Sundanese -

Swahili

Swahili -

Swedish

Swedish -

Tagalog

Tagalog -

Tajik

Tajik -

Tamil

Tamil -

Tatar

Tatar -

Telugu

Telugu -

Thai

Thai -

Turkish

Turkish -

Turkmen

Turkmen -

Ukrainian

Ukrainian -

Urdu

Urdu -

Uighur

Uighur -

Uzbek

Uzbek -

Vietnamese

Vietnamese -

Welsh

Welsh -

Bantu

Bantu -

Yiddish

Yiddish -

Yoruba

Yoruba -

Zulu

Zulu

odm thread rolling machine hsn code

Understanding HSN Codes for ODM Thread Rolling Machines

In the realm of international trade and commerce, the Harmonized System of Nomenclature (HSN) codes play a pivotal role in the classification of goods. For those dealing in machinery, specifically ODM (Original Design Manufacturer) thread rolling machines, understanding the appropriate HSN code can significantly streamline the import-export process. This article delves into the nuances of HSN codes, their importance, and how they relate to thread rolling machines.

HSN codes are internationally standardized numerical codes assigned to various products and commodities. These codes facilitate the identification of goods when it comes to tariffs, customs duties, and trade regulations. Each HSN code consists of several digits, where the first two digits represent the broader category, and subsequent numbers provide more detailed classifications. For instance, machinery used for manufacturing can fall under different codes depending on its specific applications.

Understanding HSN Codes for ODM Thread Rolling Machines

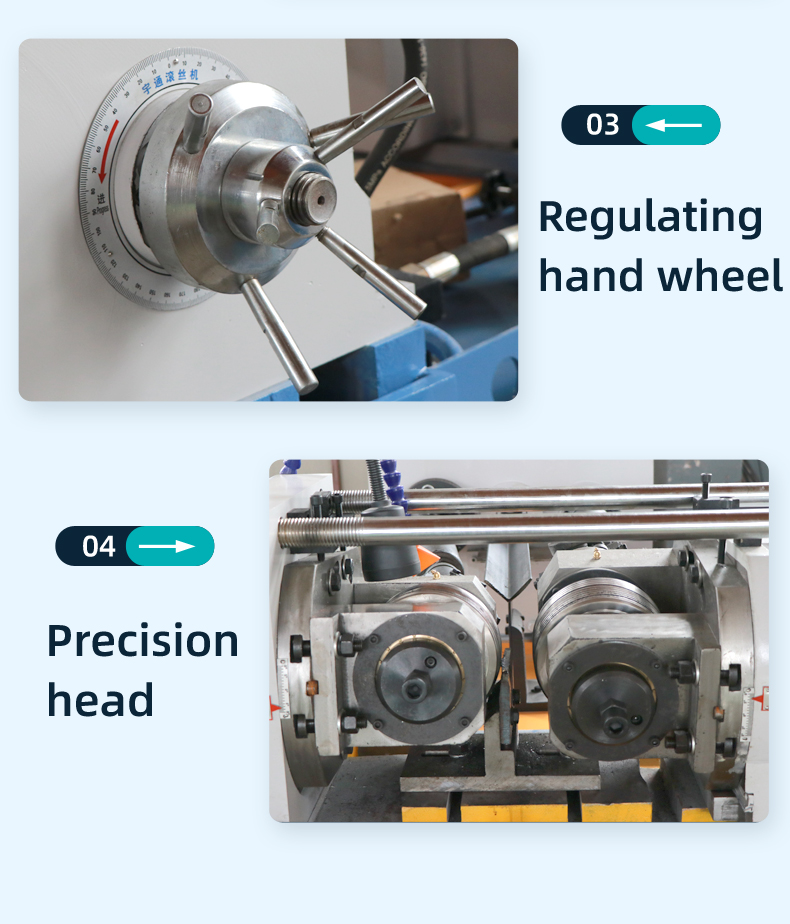

When it comes to classifying ODM thread rolling machines, it’s essential to identify their HSN codes correctly. Generally, these machines might fall under the category of “Machinery for working metal” within HSN code 8457. This category encompasses various machines used in metalworking processes, including lathes, milling machines, and, of course, thread rolling machines. However, the precise HSN code can vary based on the machine’s specific features and functions.

odm thread rolling machine hsn code

Using the correct HSN code offers multiple advantages. Firstly, it helps importers and exporters avoid delays in customs clearance. Customs officials rely on HSN codes to determine the applicable tariffs and ensure compliance with trade regulations. Implementing the wrong code can lead to penalties, rejected shipments, or additional costs.

Secondly, accurate HSN coding aids in proper accounting and taxation for businesses. The GST (Goods and Services Tax) framework, particularly in countries like India, puts substantial emphasis on correct HSN classification when calculating tax liabilities. Thus, manufacturers and traders must be diligent in their categorization during the invoicing process.

Moreover, knowing the HSN code for ODM thread rolling machines fosters better negotiation and collaboration with suppliers and manufacturers. When both parties understand the correct classifications, it promotes transparency and efficiency in transactions.

In conclusion, while the intricacies of HSN codes might seem daunting, especially for niche products like ODM thread rolling machines, understanding their importance is critical for any business engaged in international trade. Correctly assigned HSN codes not only facilitate smoother customs processes but also ensure compliance with tax regulations, ultimately contributing to better operational efficiency and profitability. As the global market becomes increasingly interconnected, the accurate classification of goods will continue to play a vital role in successful trade practices. For businesses involved with ODM thread rolling machines, investing time in learning and applying the correct HSN code is undoubtedly worthwhile.