-

Afrikaans

Afrikaans -

Albanian

Albanian -

Amharic

Amharic -

Arabic

Arabic -

Armenian

Armenian -

Azerbaijani

Azerbaijani -

Basque

Basque -

Belarusian

Belarusian -

Bengali

Bengali -

Bosnian

Bosnian -

Bulgarian

Bulgarian -

Catalan

Catalan -

Cebuano

Cebuano -

Corsican

Corsican -

Croatian

Croatian -

Czech

Czech -

Danish

Danish -

Dutch

Dutch -

English

English -

Esperanto

Esperanto -

Estonian

Estonian -

Finnish

Finnish -

French

French -

Frisian

Frisian -

Galician

Galician -

Georgian

Georgian -

German

German -

Greek

Greek -

Gujarati

Gujarati -

Haitian Creole

Haitian Creole -

hausa

hausa -

hawaiian

hawaiian -

Hebrew

Hebrew -

Hindi

Hindi -

Miao

Miao -

Hungarian

Hungarian -

Icelandic

Icelandic -

igbo

igbo -

Indonesian

Indonesian -

irish

irish -

Italian

Italian -

Japanese

Japanese -

Javanese

Javanese -

Kannada

Kannada -

kazakh

kazakh -

Khmer

Khmer -

Rwandese

Rwandese -

Korean

Korean -

Kurdish

Kurdish -

Kyrgyz

Kyrgyz -

Lao

Lao -

Latin

Latin -

Latvian

Latvian -

Lithuanian

Lithuanian -

Luxembourgish

Luxembourgish -

Macedonian

Macedonian -

Malgashi

Malgashi -

Malay

Malay -

Malayalam

Malayalam -

Maltese

Maltese -

Maori

Maori -

Marathi

Marathi -

Mongolian

Mongolian -

Myanmar

Myanmar -

Nepali

Nepali -

Norwegian

Norwegian -

Norwegian

Norwegian -

Occitan

Occitan -

Pashto

Pashto -

Persian

Persian -

Polish

Polish -

Portuguese

Portuguese -

Punjabi

Punjabi -

Romanian

Romanian -

Russian

Russian -

Samoan

Samoan -

Scottish Gaelic

Scottish Gaelic -

Serbian

Serbian -

Sesotho

Sesotho -

Shona

Shona -

Sindhi

Sindhi -

Sinhala

Sinhala -

Slovak

Slovak -

Slovenian

Slovenian -

Somali

Somali -

Spanish

Spanish -

Sundanese

Sundanese -

Swahili

Swahili -

Swedish

Swedish -

Tagalog

Tagalog -

Tajik

Tajik -

Tamil

Tamil -

Tatar

Tatar -

Telugu

Telugu -

Thai

Thai -

Turkish

Turkish -

Turkmen

Turkmen -

Ukrainian

Ukrainian -

Urdu

Urdu -

Uighur

Uighur -

Uzbek

Uzbek -

Vietnamese

Vietnamese -

Welsh

Welsh -

Bantu

Bantu -

Yiddish

Yiddish -

Yoruba

Yoruba -

Zulu

Zulu

thread rolling machine hs code exporters

Understanding the HS Code for Thread Rolling Machines A Guide for Exporters

In the global trade landscape, the Harmonized System (HS) code plays a crucial role in identifying and classifying goods. For exporters dealing with machinery, particularly thread rolling machines, understanding the relevant HS codes is essential for smooth international transactions, compliance with regulations, and effective management of tariffs.

What is a Thread Rolling Machine?

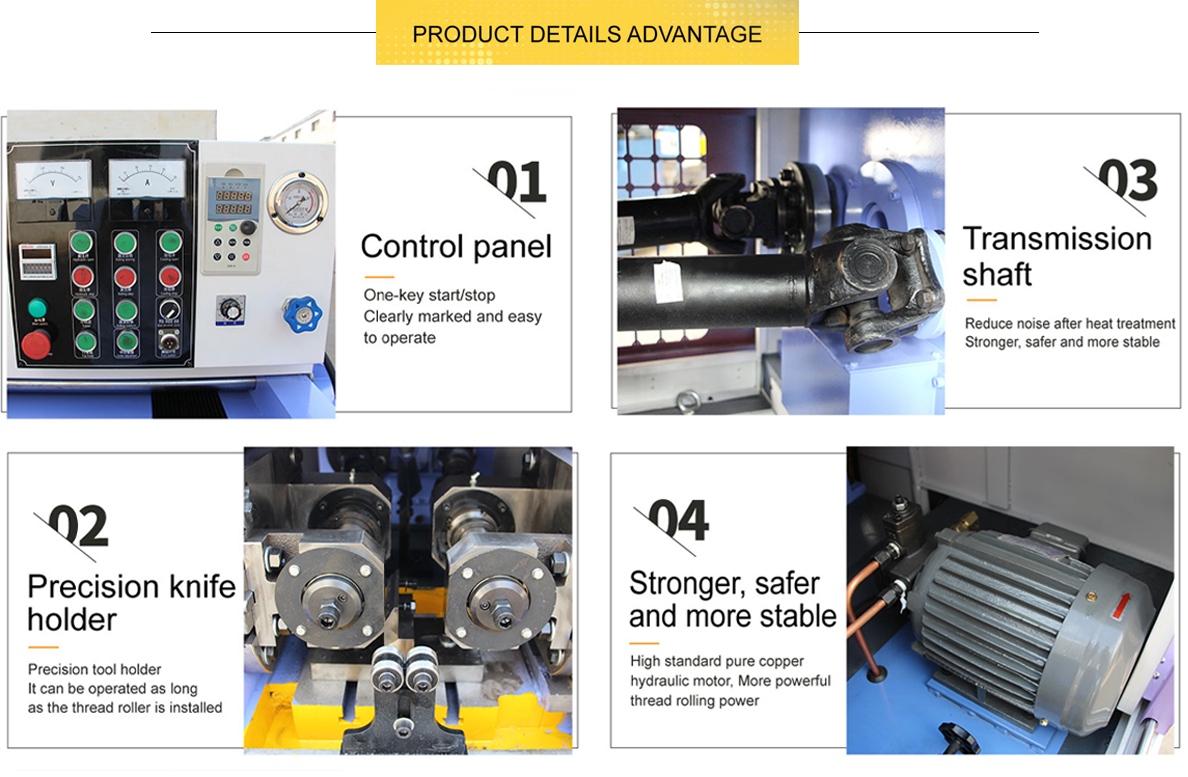

A thread rolling machine is a tool used to create threads on various materials, predominantly metals. This process involves deforming the material to form threads, making it a preferred method in industries requiring high precision and strength in fasteners, such as automotive, aerospace, and manufacturing sectors. These machines offer advantages over traditional cutting methods, including higher production speeds and improved material integrity.

HS Codes and Their Importance

The HS Code system, established by the World Customs Organization (WCO), is a standardized numerical method of classifying traded products. Each item is assigned a unique code, facilitating easier identification, compliance with tariffs, and statistics on imports and exports. The HS code for thread rolling machines falls under the category of machinery and mechanical appliances.

For thread rolling machines, the typical HS code is 8457, which covers Machinery for working metal. More specifically, it can be categorized under subheadings that point directly to the type of machinery involved. Exporters must ensure they are using the correct HS code to avoid complications that can arise from misclassification, such as delays, fines, or even confiscation of goods.

thread rolling machine hs code exporters

Exporting Thread Rolling Machines

When exporters engage in the international trade of thread rolling machines, they need to consider several factors

1. Correct Classification Ensuring the right HS code is used to streamline customs processes and avoid unexpected duties. 2. Documentation Exporters must prepare accurate documentation, such as invoices, packing lists, and export declarations, which often require the HS code.

3. Tariffs and Duties Understanding the tariffs imposed by the destination countries can impact pricing strategies. Different countries may have varying rates depending on trade agreements.

4. Compliance with Standards Many countries have specific regulations and standards that machinery must adhere to. Exporters should familiarize themselves with these to ensure their products meet all necessary criteria.

5. Logistics and Insurance Properly classifying the goods impacts shipping costs, logistics planning, and insurance coverage. Using the right HS code helps in getting accurate insurance quotes.

In conclusion, for exporters of thread rolling machines, a thorough understanding of the relevant HS codes, alongside compliance with international trade regulations, is paramount. This knowledge not only facilitates smoother export processes but also enhances competitiveness in the global marketplace. Adopting best practices in documentation and classification can lead to more efficient operations and better business outcomes.