-

Afrikaans

Afrikaans -

Albanian

Albanian -

Amharic

Amharic -

Arabic

Arabic -

Armenian

Armenian -

Azerbaijani

Azerbaijani -

Basque

Basque -

Belarusian

Belarusian -

Bengali

Bengali -

Bosnian

Bosnian -

Bulgarian

Bulgarian -

Catalan

Catalan -

Cebuano

Cebuano -

Corsican

Corsican -

Croatian

Croatian -

Czech

Czech -

Danish

Danish -

Dutch

Dutch -

English

English -

Esperanto

Esperanto -

Estonian

Estonian -

Finnish

Finnish -

French

French -

Frisian

Frisian -

Galician

Galician -

Georgian

Georgian -

German

German -

Greek

Greek -

Gujarati

Gujarati -

Haitian Creole

Haitian Creole -

hausa

hausa -

hawaiian

hawaiian -

Hebrew

Hebrew -

Hindi

Hindi -

Miao

Miao -

Hungarian

Hungarian -

Icelandic

Icelandic -

igbo

igbo -

Indonesian

Indonesian -

irish

irish -

Italian

Italian -

Japanese

Japanese -

Javanese

Javanese -

Kannada

Kannada -

kazakh

kazakh -

Khmer

Khmer -

Rwandese

Rwandese -

Korean

Korean -

Kurdish

Kurdish -

Kyrgyz

Kyrgyz -

Lao

Lao -

Latin

Latin -

Latvian

Latvian -

Lithuanian

Lithuanian -

Luxembourgish

Luxembourgish -

Macedonian

Macedonian -

Malgashi

Malgashi -

Malay

Malay -

Malayalam

Malayalam -

Maltese

Maltese -

Maori

Maori -

Marathi

Marathi -

Mongolian

Mongolian -

Myanmar

Myanmar -

Nepali

Nepali -

Norwegian

Norwegian -

Norwegian

Norwegian -

Occitan

Occitan -

Pashto

Pashto -

Persian

Persian -

Polish

Polish -

Portuguese

Portuguese -

Punjabi

Punjabi -

Romanian

Romanian -

Russian

Russian -

Samoan

Samoan -

Scottish Gaelic

Scottish Gaelic -

Serbian

Serbian -

Sesotho

Sesotho -

Shona

Shona -

Sindhi

Sindhi -

Sinhala

Sinhala -

Slovak

Slovak -

Slovenian

Slovenian -

Somali

Somali -

Spanish

Spanish -

Sundanese

Sundanese -

Swahili

Swahili -

Swedish

Swedish -

Tagalog

Tagalog -

Tajik

Tajik -

Tamil

Tamil -

Tatar

Tatar -

Telugu

Telugu -

Thai

Thai -

Turkish

Turkish -

Turkmen

Turkmen -

Ukrainian

Ukrainian -

Urdu

Urdu -

Uighur

Uighur -

Uzbek

Uzbek -

Vietnamese

Vietnamese -

Welsh

Welsh -

Bantu

Bantu -

Yiddish

Yiddish -

Yoruba

Yoruba -

Zulu

Zulu

thread rolling machine hsn code products

Understanding the HSN Code for Thread Rolling Machines and Their Products

In the global economy, the classification of goods is paramount for effective taxation, trade, and manufacturing operations. One of the systems employed for this purpose is the Harmonized System Nomenclature (HSN) code. The HSN code is a standardized numerical method of classifying traded products, which helps customs authorities identify products for the purpose of applying appropriate tariffs and taxes. This article delves into the specifics of the HSN code related to thread rolling machines and their associated products, elucidating their significance in both manufacturing and trade.

What is a Thread Rolling Machine?

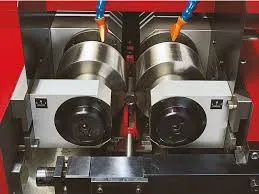

A thread rolling machine is a specialized piece of equipment used in manufacturing to create threads on various materials, typically metals. Unlike traditional methods that involve cutting threads, thread rolling is a cold forming process where a blank is passed between rollers that imprint the desired thread profile onto the surface. This technique not only enhances the precision of the threads but also improves the mechanical properties of the material, making it stronger due to the work hardening effect.

These machines come in various types, including flat die, cylindrical die, and multi-stage rolling machines. Manufacturers use them to produce components with threads that are essential in numerous applications, from automotive parts to construction materials.

The Importance of HSN Codes

The HSN code system simplifies international trade by reducing complexities in customs processes. This standardization is crucial in determining tariff rates, facilitating more straightforward import and export procedures across different countries. The specificity of HSN codes allows businesses to classify their goods accurately, reducing the risk of misclassification that can lead to legal issues or financial penalties.

HSN Code for Thread Rolling Machines

thread rolling machine hsn code products

For thread rolling machines, the HSN code typically falls under the broader category of machinery used for working metal. In the Indian context, for example, the relevant HSN code for thread rolling machines is 8462. This section encompasses various types of machine tools, including those used specifically for the processing of metal, which includes thread rolling equipment.

This categorization plays a vital role for manufacturers and suppliers involved in the production and distribution of these machines. Understanding the correct HSN code is essential not only for compliance with tax obligations but also for maintaining accurate inventory records, facilitating international shipping, and ensuring that the end products meet requisite standards.

Products Associated with Thread Rolling Machines

Thread rolling machines are used to manufacture a wide array of products that are integral to several industries. Examples of products created using these machines include

1. Bolts and Nuts Essential fasteners used in construction, automotive, and machinery applications. 2. Screws Utilized in various assembly processes, from furniture manufacturing to electronics. 3. Studs Commonly used in structural applications where strong attachment points are needed. 4. Threaded Rods Often used in scaffolding, engineering structures, and other applications requiring strength and stability.

Each of these products also has its own specific HSN code, which allows customs authorities to manage and track trade efficiently. Knowing these codes is crucial for businesses engaged in international trading, as it affects pricing, duties, and the overall competitiveness of their products in the global market.

Conclusion

The HSN code for thread rolling machines and their associated products plays a crucial role in the manufacturing and trade sectors. By understanding this framework, businesses can navigate the complexities of international trade, comply with regulations, and optimize their operations. As the global marketplace continues to evolve, adopting such standardized systems ensures that manufacturers remain competitive and efficient while facilitating smoother trade interactions across borders. Whether you are a manufacturer, exporter, or importer, being well-versed in the HSN code relevant to your products is not just an obligation but a strategic advantage.